Across America, a new face of house possession has arisen, that of the institutional investors. They are growing their ownership to not just residences, which they have customarily owned, but to single family homes, in bulk, with the purpose of renting to the form of people who would usually invest in them. Causes ranging from scholar loans to just obtaining outbid by private fairness have a lot of center course would-be homebuyers stuck leasing as a substitute.

A single of the most nicely-known institutional buyers in single family housing is Invitation Properties. Established in 2012, it is the biggest operator of one household homes in the United States. Despite promising reasonable selling prices and facilities, in follow Invitation Houses is not only more costly than the normal rental, but has been concerned in a variety of scandals relating to the high-quality of the houses it delivers. With 12,556 solitary loved ones properties at an normal rent of $1,600 for every month, the precise market of Atlanta, Georgia tends to make up the biggest personal contribution to Invitation Homes’ profits and is the put wherever it has the most single-family ownership overall.

The concern with Invitation Residences is not automatically the quantity of the properties they have, but the gap concerning its higher than-common rental rates and the actual good quality it offers. Even though its rental houses make up only a smaller portion of Atlanta’s housing market place, as according to the Census Reporter, there are about 2,364,761 housing models in the Atlanta Metropolitan spot, but they and other individuals less than equivalent possession make a suggestive circumstance analyze of the institutional trader-owned rental encounter.

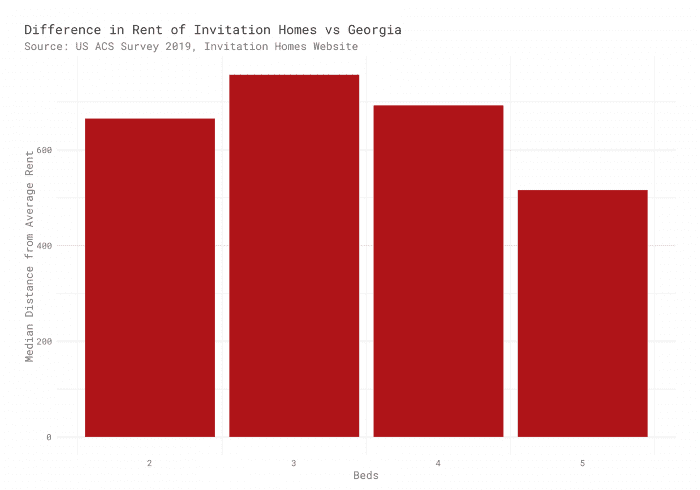

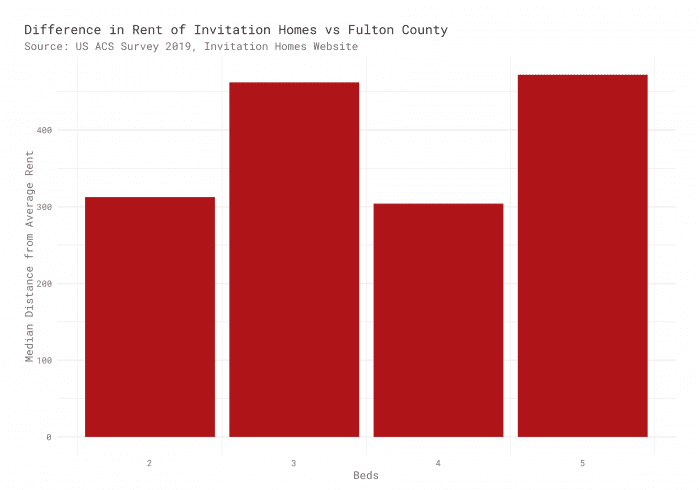

Working with the listing of housing out there to lease in Ga from Invitation Properties internet site, it is attainable to scrape with each other the information, including rents, and cross assess them to the median hire of not only Ga broadly, but of Fulton County, and even the individual tracts within the counties that make up suburban Atlanta.

Evaluating median rent per bed room to the average in both of those Ga and Fulton county, Invitation Residences rentals are, as reported in other places, high-priced.

That Invitation Households houses are much more high-priced even at the tract degree exhibits that the problem is even bigger than just buying solitary family properties in affluent communities and jacking up the price tag. For case in point, simply click via for a comparison of typical rent for a a few bed room in a specified tract, compared to the sector hire of a 3 bedroom house for lease by Invitation Households.

It is not just key players like Invitation Households there are a great deal of smaller sized players, with considerably less than 100 houses every, which are even now supported by a big resource of funds. However, in spite of becoming smaller in scale, it is not uncommon for the tiny men to behave just as unfairly as their larger sized counterparts.

The scenario of Jar House, a partner of Najarian Money (which obtained PPP loans in the course of the Covid-19 disaster), is a person such example. Jar House operates by purchasing distressed qualities, normally foreclosed kinds, and either flipping them to provide to a consumer at revenue or leasing them out for a increased-than-normal price tag. Back in 2019, a damaged septic tank was identified in a assets acquired from Jar Home. The corporation had not notified the buyer. Even worse, prior to reaching a settlement, Jar Home argued that mainly because they really do not in fact dwell in the houses they offer, they are not liable for any flaws that the qualities may have, irrespective of ostensibly renovating them to flip. All over again, in 2018, Jar Home offered a property with a big mould infestation, without informing the purchaser and requiring the purchaser to sue thanks to concealment of the damages.

For a different institutional renter example, take the Canopy Improvement Team. Even with the innocuous site, it turns out the proprietor of the LLC, Rick Warren, made use of this entity as yet a different front to act as a slumlord. A number of several years ago he was arrested for acting as an absenteelandlord and for standard housing code violations.

Although only a sample of the sorts of players that make up Atlanta genuine estate, it is telling that these incidents are prevalent at both equally a modest scale, regional scale, and nationwide scale. These gamers don’t want a stable housing industry in the slightest they want to make a revenue.

In its S11 registration, Invitation Houses frankly states the industry conditions it prefers when purchasing single spouse and children homes:

We spend in markets that we assume will show decreased new provide, much better task and residence development expansion and exceptional NOI expansion relative to the broader U.S. housing and rental market. In our 13 markets, we concentrate on eye-catching neighborhoods in in-fill areas with various need generators, this kind of as proximity to key work centers, desirable faculties and transportation corridors.

Place a lot more simply, Invitation Houses likes areas that mature but do not create any housing, and it prefers a market place that stays that way. In common, any landlord whose houses consist of one family members housing implicitly has this mindset—profit is found exactly where provide is set and need is expanding.

Fortunately, the industry does not have to be like this. There are choices offered to resolve the concern of huge scale financial investment in housing for family members, and more mild can be shone on these market techniques.

On the regulatory facet, outside of just bluntly regulating institutional ownership of housing, increasing the parcel reporting capability of states and counties would make it a lot easier to track possession. On company registries, it ought to be necessary that all LLCs a offered corporation controls should really be linked to it and to every other, so that a massive institutional entity cannot hide its possession of properties via nesting them in different shell organizations.

On the housing side, the most straightforward alternative would be to build much more housing. This might require upzoning to allow for more multifamily housing, or at the very least much more dense solitary family members properties. Or potentially it would indicate allowing the typical enhancement of accessory dwelling units. No matter, developing more housing will help all people, as it makes it easier for another person to own a home, with all the stability that arrives with it.

Institutional investment in solitary family housing on the a person hand, and immediate boost in the housing supply on the other, both equally existing a exclusive difficulty, in that, largely by accident of government policy, the benefit of one’s owned property is the most important way that many American households create wealth. Of system, if housing were to be commodified, worth would be suppressed. As far more housing is crafted, substitute motor vehicles for making prosperity will be expected to assure that as just one vehicle for prosperity acquisition is taken out, a different is delivered.

At the conclusion of the working day, each and every American really should be equipped to have housing in the method they like, whether as a renter or a property owner. Recognizing the troubles of the second and reforming housing markets to make this the scenario will make everybody much better off.

Lars Schonander is a software engineer at Lincoln Community. This New Urbanism sequence is supported by the Richard H. Driehaus Foundation. Follow New Urbs on Twitter for a feed dedicated to TAC’s protection of cities, urbanism, and place.